Quinnox Implements Qinfinite Chaos Engineering to Help A Bottling Manufacturer

Future-Proof Your IT with Qinfinite’s AI-Powered Asset Management

Achieve unparalleled visibility, optimize resource utilization, and drive efficiency across your IT ecosystems with intelligent, unified infrastructure monitoring platform.

Transforming Ideas into High Performance Products

At Quinnox, we specialize in delivering High Performance Product Engineering services that are designed to meet the ever-evolving demands of the modern business landscape. By leveraging cutting-edge technologies and best practices, we create robust, scalable, and secure products that drive business growth and enhance user experiences.

Our approach is rooted in agility, intelligence, and a deep commitment to quality, ensuring that our solutions not only meet but exceed client expectations.

Read moreQinfinite’s AI-Powered Asset Management That Outperforms the Rest

Delivering unmatched efficiency, real-time insights, and proactive optimization across all environments—cloud, on-prem, and hybrid.

Continuously discovers and inventories assets across cloud, on- prem, and hybrid environments.

Leverages the Knowledge Graph for contextual asset relationships and dependencies, enhancing impact analysis.

Monitors asset lifecycle stages (acquisition, utilization, retirement), ensuring timely renewals and replacements.

Provides real- time compliance status and generates audit- ready reports, ensuring adherence to regulatory standards.

Continuously monitors asset health, proactively identifying issues or vulnerabilities.

Tracks asset costs, depreciation, and utilization for improved financial planning and budgeting.

Offers data- driven insights on asset usage, performance, and optimization, aiding faster and informed decision- making.

Supports diverse IT environments, providing consistent asset management across on- prem, cloud, and hybrid setups.

Effortlessly Manage and Optimize IT Assets with Qinfinite’s Advanced Features

Streamline your IT asset lifecycle, reduce costs, and enhance performance with AI-driven infra monitoring tools.

- Live & enriched CMDB

- Infrastructure Asset Discovery

- Application Asset Discovery

- Code Discovery

- Topology / Assembly Creation

- Knowledge Discovery

- BizOps Dashboard

- FinOps Dashboard

Voices of our Clients

“There were a lot of test platforms out there that do mobile or web or API testing. The beauty of Qyrus is that you can build a scenario and string add in components of all of those three to create an end-to-end scenario. And that is what we found to be most impressive in Qyrus.”

CTO, a Digital bank headquartered in UK

"With the dashboard that it provides for ease of reporting because it's a codeless platform, Qyrus allowed us to get up and running very quickly."

Test and Release Manager, Digital bank in UK

"With every release that we were doing, the testing time kept increasing due to regression testing. This was not sustainable as it took time from the testing and business users - people in the lending, client servicing, and savings teams - away from their other core responsibilities."

CTO, a Digital bank headquartered in UK

"To me, the biggest benefit we got (from Qyrus) is the repeatability of the release cycles because the regression is now fully automated. Where previously, the cycle kept increasing due to the regression, now the release cycle is not going to increase."

CTO, a Digital bank headquartered in UK

"We found a model (with Qyrus) that works for us as we have a couple of people on our team working with a larger team in Quinnox to deliver automation test cases faster at scale. This is possible because the professional services charges are very reasonable given the labor arbitrage advantages."

CTO, a Digital bank headquartered in UK

Transforming IT Asset Management into a Strategic Advantage

Unlock operational efficiency and financial gains with AI-driven intelligent asset management.

90-100% asset visibility, reduced manual inventory tasks

20-30% improvement in asset utilization by identifying underused or redundant assets

15-25% reduction in costs by minimizing unused or redundant assets through proactive asset management

100% compliance with audit requirements by maintaining accurate, up- to- date asset records

20-30% reduction in Mean Time to Resolution (MTTR) by providing asset data during incident management.

15-25% increase in lifecycle efficiency through timely tracking and updates for asset renewals/replacements.

80-100% reduction in lost or misplaced assets by continuously monitoring asset status and location

10-20% improvement in budget forecasting by accurately tracking asset costs and depreciation

15-20% reduction in security risks by identifying outdated or vulnerable assets in the environment

20-30% faster decision- making regarding asset allocation, upgrades, or decommissions based on real-time data

Recognized in Forrester's "The AIOps Platforms Landscape"

Quinnox, a leading digital transformation partner leveraging advanced technology solutions, proudly announces its inclusion as one of the Top 25 Vendors in Forrester's The AIOps Platforms Landscape, Q4 2024.

Read more

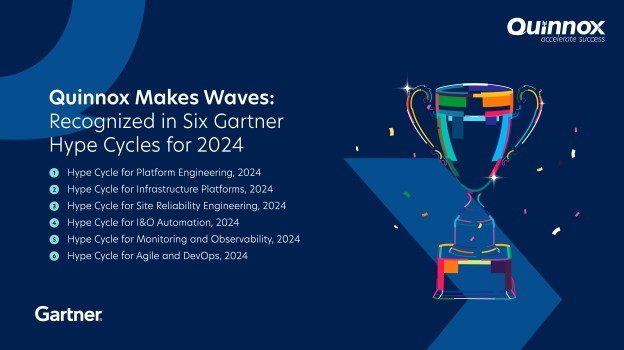

Recognized in Six Gartner Hype Cycles for 2024

Quinnox has been recognized in six Gartner Hype Cycles for 2024.This recognition is a testament of our commitment to revolutionizing application management with the power of AIOps and the advanced capabilities of Qinfinite, our intelligent Application Management platform.

Read more

Intelligent Application Management (iAM) Maturity Assessment

This iAM Maturity Framework provides a clear pathway for enterprises to evaluate their current capabilities and identify areas for improvement, helping them evolve toward a fully adaptive and future-ready iAM platform.

Start My Assessment

Case Studies

Discover how Qinfinite empowers organizations to optimize, modernize, and innovate with accelerated business outcomes.

Related Insights

Learn how our solutions have accelerated our client’s journey towards becoming an intelligent enterprise.

AIOps in 2024: Hype vs. Reality & Evolution of iAM

Demystify the truth behind AIOps and discover how Intelligent Application Management (IAM) is redefining IT operations landscape. Watch the on-demand webinar!

Read moreUnlocking Legacy Potential: How Intelligent Twin Power Modernization

Watch on-demand webinar to get insights & strategies from Forrester analyst on how to navigate complexities of modernization

Read moreDeliver Value to Succeed in Implementing AIOps Platforms

Download the Gartner® Report | Deliver Value to Succeed in Implementing AIOps Platforms According to a Gartner® report, 46% of IT leaders cited issues about understanding the benefits, value, and use cases as top barriers to successful AI implementation. Moreover, the complexity, volume and velocity of monitoring telemetry has increased so much that it is […]

Read moreFrequently Asked Questions (FAQs)

Why is software testing and QA important in insurance?

Software testing and QA are vital to ensure the reliability and security of systems handling sensitive customer data.They prevent costly errors, enhance user experiences, and maintain regulatory compliance.

Are there any challenges in implementing intelligent automation in insurance?

Insurance company faces challenges like legacy systems, data integration, and employee resistance. Overcoming these hurdles involves comprehensive planning, change management, and retraining.

How will automation impact insurance?

Automation promises efficiency gains in underwriting, claims processing, and customer service, enabling insurers to lower costs, improve accuracy, and offer more competitive rates.

How does testing enhance customer data security in the insurance sector?

Testing strengthens customer data security by identifying vulnerabilities, ensuring compliance with regulations, and safeguarding against cyber threats, bolstering trust

Are there specialized tools for software testing in the insurance sector?

Yes and these specialized testing tools streamline quality assurance, from policy validation to claims processing, ensuring accuracy and compliance.

What benefits do cloud-native applications bring to insurance companies?

Scalability, flexibility, and cost-efficiency. They allow for rapid innovation, easy data access, and seamless collaboration, enhancing overall operational efficiency.

Can data modernization improve underwriting in insurance?

Data modernization provides insurance companies with better insights into risk assessment, resulting in more accurate pricing and reduced losses.

What are the main challenges in migrating legacy insurance systems to modern applications?

Migrating legacy insurance systems to modern applications can be challenging due to data migration, integration issues, and ensuring compliance with industry regulations. It requires careful planning and execution.

What are the current CX trends in the insurance industry?

Current CX Trends include Personalized customer experiences, digital self-service options, AI-driven chatbots for customer support, and data analytics to better understand customer needs and behaviors.

How is digital transformation changing customer interactions with insurance companies?

Digital transformation is revolutionizing customer interactions with insurers through AI chatbots, online policy management, and mobile apps, offering convenience and efficiency.

Is data security a concern with cloud implementation in insurance?

Yes, data security is a significant concern in cloud implementation. It’s crucial to ensure robust encryption, access controls, and compliance with regulations to protect sensitive information.

What are some major challenges in the insurance industry?

Major challenges are increasing cyber threats, evolving regulations, competition, and complex underwriting processes. Adapting to changing customer expectations is also a significant challenge.

How to choose the right insurance provider for my digital transformation journey?

To choose the right insurance provider for your business, consider factors like coverage options, financial stability, customer service, and pricing, aligning with your specific needs.

Should insurers integrate with insurtech platforms?

Insurers can benefit from integrating with insurtech platforms to enhance customer experiences, streamline processes, and access advanced data analytics for better decision-making.

How can insurance companies benefit from API integration?

Fosters connectivity, improving data exchange with partners, and enhancing adaptability to market changes.

Can API integration be used for real-time quotes and policy issuance?

Yes, API integration allows for quick access to external data sources and facilitates real-time interactions with customers, improving service efficiency and customer satisfaction.

How can a system integrator help insurance companies with legacy systems?

System integrators help insurance companies by modernizing legacy systems, improving data flow, and reducing operational costs.

What strategies are insurers using to future-proof their applications?

Insurers future-proof applications by embracing microservices, cloud technologies, and modular architectures, allowing for flexibility and scalability

What are the costs associated with application maintenance in insurance?

Application maintenance costs in insurance encompass software updates, security enhancements, and performance optimization, ensuring systems remain robust and efficient.

What are the benefits of using insurtech solutions?

Insurtech solutions offer benefits such as personalized policies, quicker claims processing, and improved customer engagement, driving industry innovation

What are common risks covered by tech insurance policies?

Tech insurance policies commonly cover risks such as data breaches, cyberattacks, intellectual property disputes, and technology errors, providing comprehensive protection.

How is Insurtech Better than Traditional Insurance?

Insurtech is superior to traditional insurance due to faster, personalized services, greater transparency, and innovative products tailored to evolving customer needs

What is the role of insurance technology in enhancing CX?

Technology plays a vital role in CX enhancement in insurance by enabling digital platforms, predictive analytics for risk assessment, and mobile apps for policy management, making interactions more convenient and efficient.

What are some emerging trends in insurtech?

IoT-enabled policies, blockchain-based claims processing, and AI-driven underwriting, all designed to streamline operations and improve customer engagement.

Case Studies

Our client stories highlight how our software testing solutions have improved the quality of products and services. See how we have collaborated with our clients to make a significant difference with our automated testing solutions.

Quinnox Implements Qinfinite Chaos Engineering to Help A Bottling Manufacturer

Our client is one of the largest and most complicated bottling and distribution operations in the world.

Read moreEnhancing a logistic company’s supply chain resilience with Chaos Engineering

Our client is the largest independent mail, courier and logistics operator in the UK and Ireland

Read moreTransforming IT Operations: How Qinfinite’s Auto Optimize Revolutionized High-Tech Manufacturing for a Leading U.S. Company

The client is a leading U.S.-based high-tech company, leveraged Qinfinite’s Auto Optimize to transform their IT operations, ensuring high availability and cost efficiency

Read moreQuinnox reduces 20% of maintenance cost for leading provider of integrated environmental solutions

The client needed a vendor to solve very large and complex Supply Chain and Logistics problems.

Read moreGet Free Demo

Explore Qinfinite, your AI-powered Intelligent Application Management (iAM) platform. Request a free demo today and see how it can transform your business

Request Free Demo

Contact Us

Fill out the form below to know what Quinnox can do for you.