The Foundation for Innovation: Why Legacy Modernization is Essential for a Successful AI Strategy

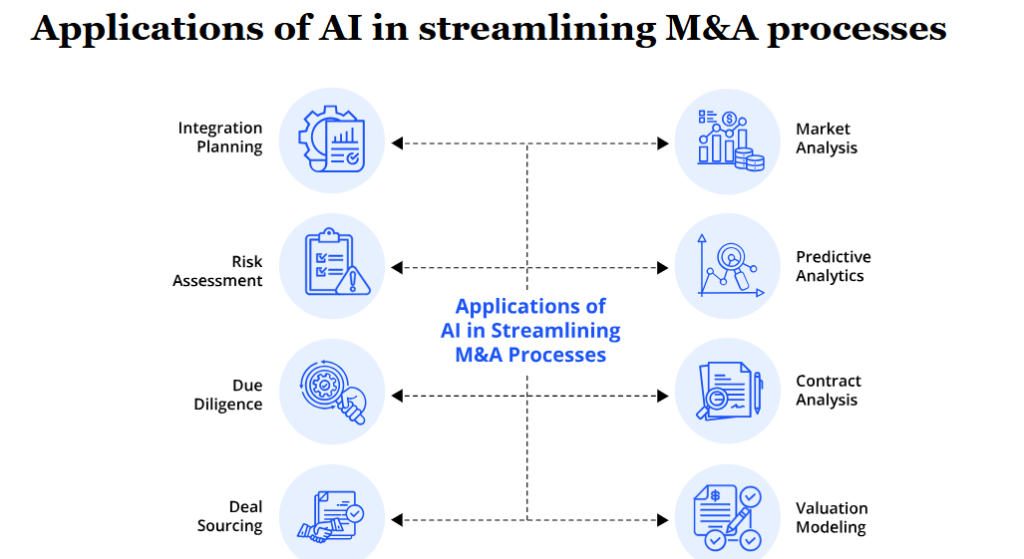

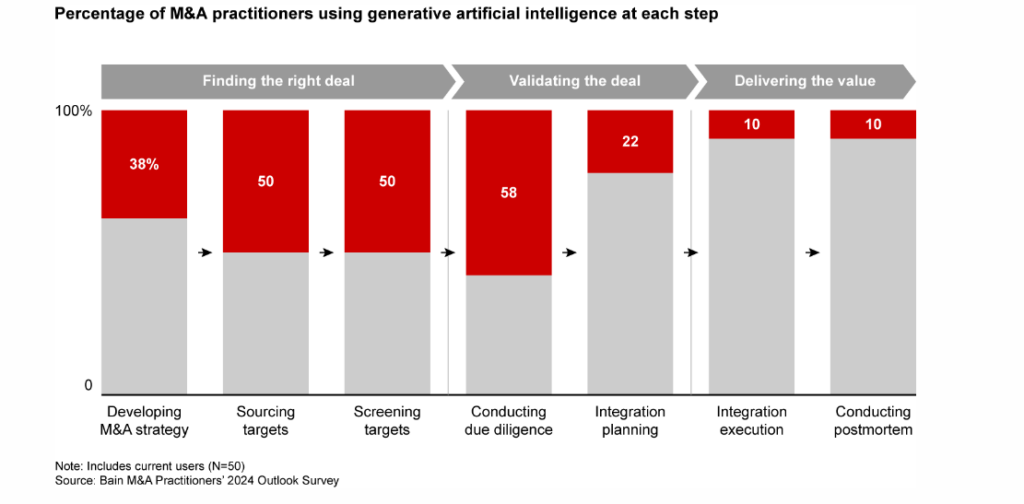

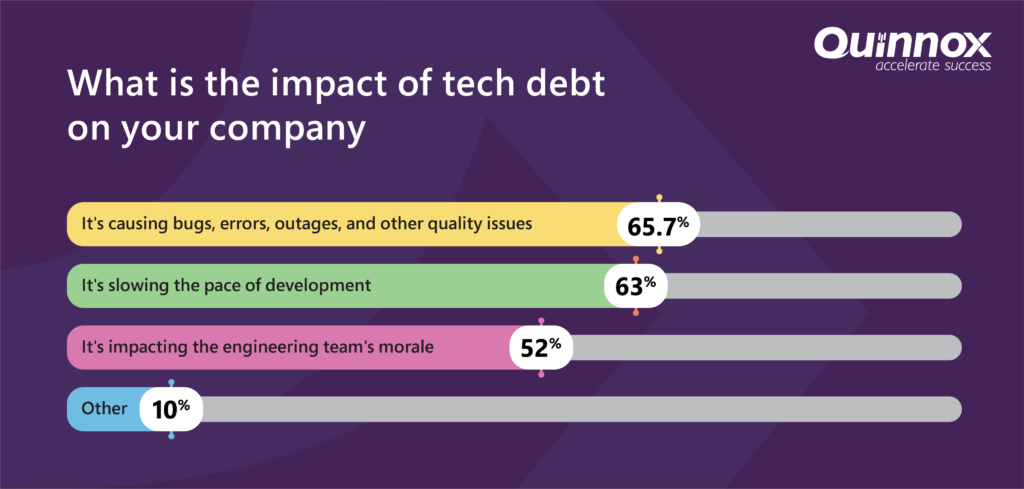

In today's competitive landscape, organizations are constantly seeking innovative ways to gain a competitive edge. Artificial intelligence (AI) has emerged as a powerful tool for optimization, automation, data-driven decision making and productivity

Read more