Did you know that legacy systems can increase your annual maintenance expense by up to 15%? Legacy trading systems have long served as the financial industry’s backbone. However, these systems have significant flaws that prevent banks from keeping up with the changing regulatory landscape and attaining maximum efficiency.

But before we delve into the solutions that Calypso can help with, let us discuss some of the challenges of legacy trading systems:

These shortcomings result in higher costs, inefficiencies, increased risk, and an inability to meet the demands of current trading operations.

Now that the wave of regulations is nearing its end (Basel III, for instance, implemented on January 1, 2023) and with the recent collapse of known banks, there is dire need to start employing streamlined technology to take advantage of available data to identify and tackle risks – something legacy systems do not offer.

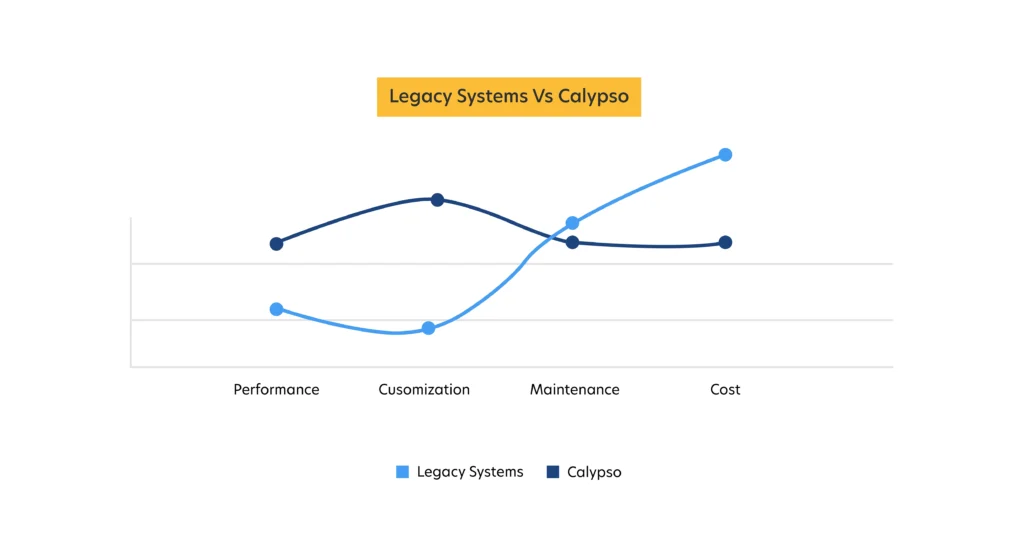

To overcome the limitations of legacy trading systems, it is crucial for financial institutions to embrace modern technology. For organizations still running legacy systems, maintenance alone can account for a significant proportion of any IT budget, and the cost of inflexibility can stifle innovation. Running operations on legacy systems does not just increase costs and inefficiencies but also welcomes unnecessary risk.

Global investment banks are spending vast sums each year on their brokerage fees and billing operations, but data challenges, lack of automation, and legacy technology make it difficult to understand and therefore optimize their spend across the organization fully

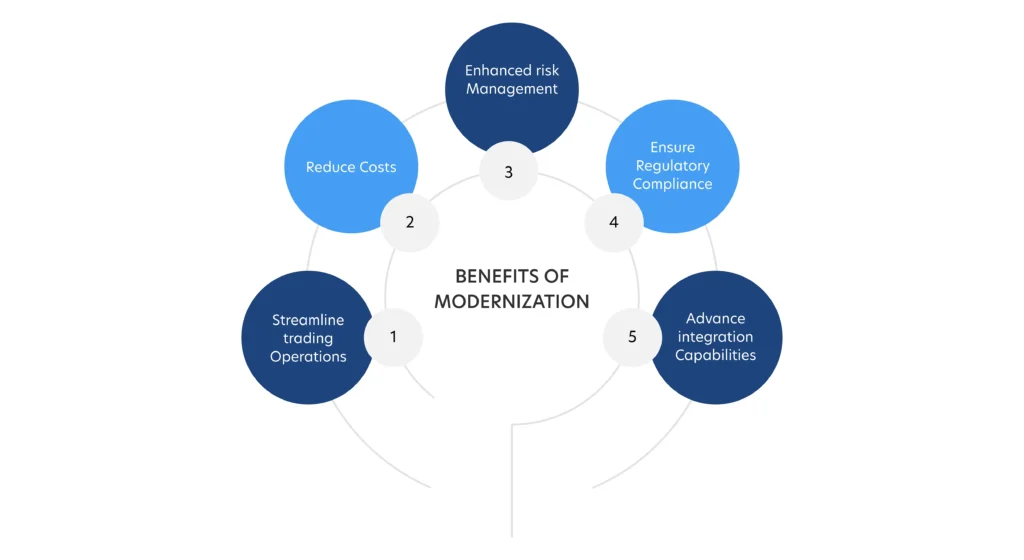

Migrating to modern trading systems such as Calypso helps banks to address the challenges posed by complex regulations, automate processes, enhance risk management, and improve operational efficiency. Modern technology provides the agility, integration capabilities, and compliance functionalities necessary to thrive in the trading industry.

Moreover, Calypso has announced Project Simplify, an initiative that transforms how we deliver software updates. With Project Simplify, you will enjoy faster and easier access to security patches, software enhancements, and significant technological innovations. Project Simplify will help you run the Calypso platform at its best, with full functionality and minimal hassle.

A new study by Coalition Greenwich, based on conversations with over 30 senior bank executives overseeing trading and risk functions at top-tier and regional investment banks across the United States, Europe, and Asia, suggests:

As tech is upgraded, most banks are looking at platform-based providers as a route to cutting costs and increasing automation and are open to working with F-Fintech partners

Calypso, a leading modern trading system, offers a wide range of benefits for financial institutions transitioning from legacy systems. By leveraging Calypso’s advanced features, banks can streamline trading operations, reduce costs, enhance risk management, improve client on boarding processes, and ensure regulatory compliance. Calypso’s integration capabilities, analytics support, and automation features empower banks to achieve operational excellence, mitigate risk, and drive growth in the ever-changing trading landscape.

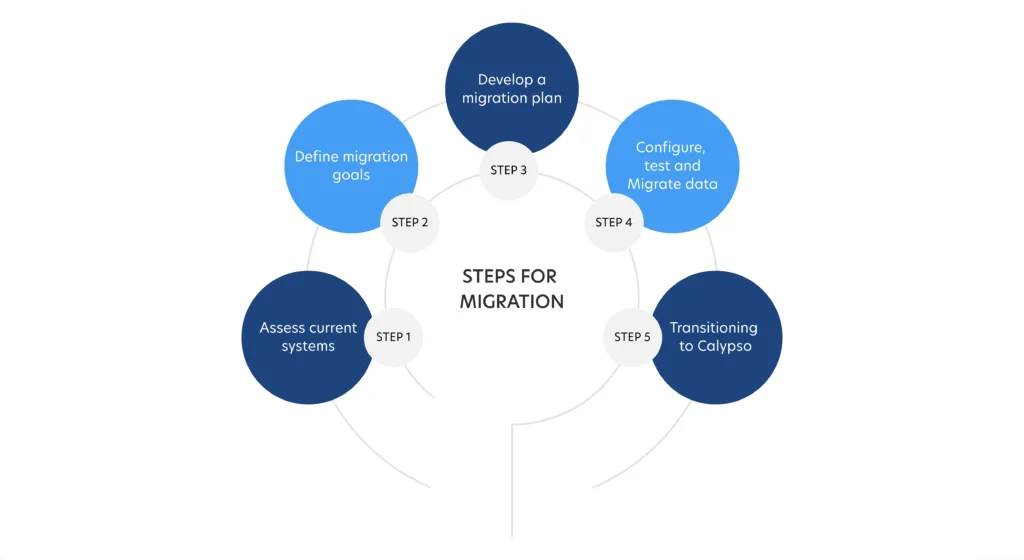

Here is why Quinnox and Adenza are your ideal partners for migrating from legacy trading systems to Calypso, the leading provider of cross-asset trading software.

Modernizing legacy trading systems by transitioning to Calypso is essential for financial institutions to overcome the shortcomings of outdated technology. By embracing modern technology, banks can enhance efficiency, improve risk management, streamline workflows, and ensure compliance with evolving regulations. The partnership between Quinnox and Adenza provides the necessary expertise and support to facilitate a seamless transition, enabling organizations to unlock the full potential of Calypso and thrive in the modern trading finance landscape.

Moreover, its high time that Banks make the transition move towards Calypso to simplify, streamline and standardize trading floor technology to scale up their businesses in the future. We would urge you to adapt to the modern days trading applications, connect with us, and we can help you decide the next steps in your transformational journey.

Reach our experts to to get started today!